Unprecedented Amounts of Bitcoin Are Being Removed From Exchanges

Unprecedented Amounts of Bitcoin Are Being Removed From Exchanges

Currently, there are roughly 18.6M Bitcoins that exist (maximum of 21M Bitcoins). Since March of 2020, when Covid fear reached its peak, lockdowns commenced all across the world, and markets collapsed, the number of Bitcoins held on exchanges has decreased at an unprecedented pace.

Directly before the 2017 bull run, we saw a much smaller, but similar phenomenon. In August of 2016, we witnessed total exchange balances peak at 1.06M BTC. At the beginning of 2017, 0.94M BTC remained on exchanges, meaning 120,000 BTC were removed (-11% decline).

This bull run appears to be telling a more extreme story. In March of 2020, there were a total of 2.97M BTC held on exchanges. Today there are 2.33M BTC held on exchanges, meaning 640,000 BTC have been removed (-22% decline).

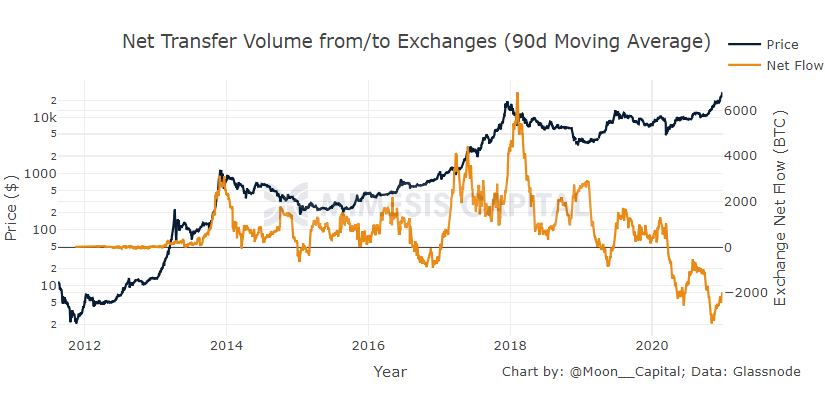

Looking at the 90 day moving average of the Net Transfer Volume from/to Exchanges, we can better visualize the amount of Bitcoins getting removed from exchanges in comparison to 2016/2017.

We can specifically look at the Coinbase Bitcoin Balance. Since the beginning of December 2020, a net 75,000 BTC have been withdrawn from Coinbase. This is Bitcoin leaving the world’s largest exchange (BTC Balance wise) at an incredibly fast rate.

This data clearly shows that Bitcoins are being removed from exchanges at a rapidly unprecedented pace. Why is this occurring?

HODL FOMO?

A term coined by Brady Swenson at Swan Bitcoin, HODL FOMO, is another word for what Preston Pysh has referred to as “Escape Velocity”. This means that Bitcoin may be entering one of its last major bull markets before global adoption. Coins are being removed from exchanges because the new HODLers of those coins have no intention of selling those coins for dollars, ever.

Unlike 2017 and all other previous Bitcoin bull markets, the 2020/2021 bull run may not be driven by “FOMO”, instead it may be driven by the fear of losing wealth by holding significant wealth in anything that is not Bitcoin.

Why should you hold long duration bonds when fiat currencies are being endlessly inflated and simultaneously getting obliterated in value compared to Bitcoin? Why should you hold equities at historically high valuations when you can store wealth in an asset with no counterparty risk and no dilution risk? Why should you hold real estate when property taxes appear to be increasing infinitely, rent controls and socialism appear to be coming soon, and valuations are astronomical due to mortgage rates at all time lows?

It appears that more people are beginning to understand the power of Bitcoin’s two unprecedented characteristics. (1) No counterparty risk. (2) No dilution risk. At the same time, Bitcoin is becoming exponentially more scarce after each halving, with the most recent halving occurring in May of 2020.

The flow of Bitcoin out of exchanges as well as the rapid price appreciation shows that more and more people are taking full possession of their bitcoin and locking it up with no intention of trading it for dollars.

GBTC / BlockFi are Capturing Coins

Since February of 2020, roughly 319,000 BTC has been added to $GBTC. Where are these coins coming from? Most are from Crypto/Bitcoin funds like Three Arrows Capital and yield generating products like BlockFi and Tantra.

All of these funds and products are capturing the GBTC premium by sending coins to Grayscale, selling GBTC, and capturing the premium.

While 319,000 BTC is certainly a significant amount of Bitcoin, it is still slightly less than half the total number of Bitcoins that have been removed from exchanges since the market, indicating that hundreds of thousands of Bitcoins are likely being removed from exchanges directly to cold storage.

HODLers Are Not Selling

We are approaching a period in Bitcoin’s history where a large majority of big Bitcoin holders have very little incentive to trade their Bitcoin for dollars, ever. Most Bitcoin are locked away in cold storage with almost no intention of being sold in any meaningful amount. The few Bitcoin still on exchanges and being held by weak hands are currently being scooped up at any price.

We are possibly witnessing the first inning of a Bitcoin super cycle where Bitcoin’s price (denominated in fiat currencies) may begin to reach unimaginable levels.

“Only keep money in fiat that you’re willing to lose.” — Max Keiser

Written by Joe Burnett (@Moon__Capital), Research Analyst at Mimesis Capital.